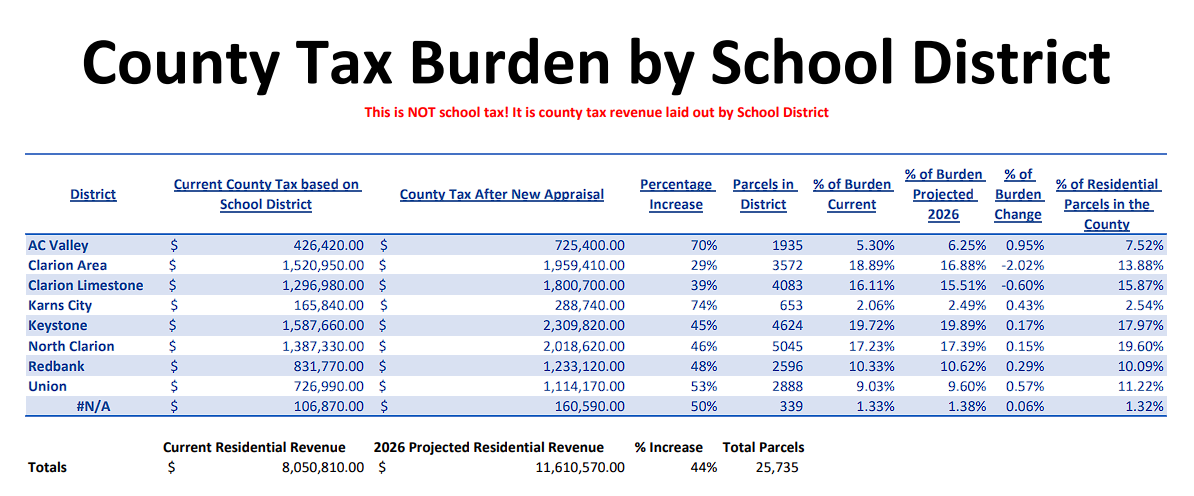

County Tax Burden by School District

While we are awaiting the outcome of our appeal to the Office of Open Records regarding our latest RTK request for commercial data, we've been reviewing the residential data in the meantime.

It's important to clarify that this data does not pertain to school taxes. Instead, it reflects county tax revenue distributed by each school district. The dataset is a combination of information obtained through RTK requests and data extracted from the County Parcel Viewer (which you can explore to view property lines, similar to OnX Maps {Mysteriously, as of 7:40am 2/8/25, the county hosted map is offline. Thank goodness we already have the data}). We utilized this data to identify which school district each property belongs to.

The two main areas of interest are:

- The percentage of residential properties versus the tax burden they experience.

- The percentage change in tax burden for each district.

See the data attached below: