County Tax Re-Assessment Impact Visualized

There are a few key points to understand about the data maps. They are derived from a combination of reappraisal data and information obtained from the county’s GIS Parcel Viewer website.

(An interesting side note: Since we published our article on February 6th, “County Tax Burden by School District”, in which we mentioned extracting data from the county maps, the GIS Parcel Viewer website has been taken down. We’ll leave it at that—though we hope we don’t sound like conspiracy theorists.)

One major issue with the data is inaccuracies regarding the physical location of parcels. Many large farms, mineral exploration companies, and private camps have mailing addresses that differ from the actual parcel location. This location is commonly referred to as the Situs Address. However, neither the data obtained through our right-to-know request nor the data extracted from the Parcel Viewer website contain the correct situs addresses. As a result, some anomalies appear in the maps, where parcels seem to be located outside county lines. This occurs because, in the absence of a situs address, the plots are mapped to their mailing addresses instead. That said, the tab 1 labeled “Based on $ Change by District” accurately reflects the school district in which each property is physically located.

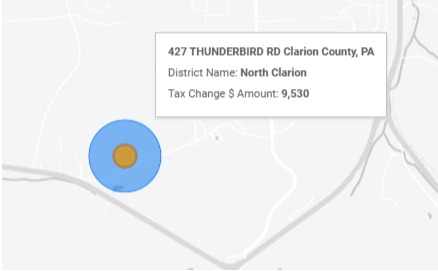

Both maps visualize data based on the actual dollar amount increase in parcel taxes rather than percentage increases. This approach better highlights the significance of the changes. In some cases, the bubbles or heat signatures represent multiple parcels owned by a single entity.

For example, one bubble represents a combination of parcels owned by the same entity, which experienced the following increases in county tax burden:

- $9,530 in North Clarion SD

- $930 in Clarion-Limestone SD

- $1,950 in Clarion Area SD

These figures exclude school taxes. Their current county tax burden stands at $3,970 and will increase by $14,020, bringing the total county tax burden to $17,900. Keep in mind that this amount does not include additional tax burdens from school districts and other municipalities.

Another noteworthy anomaly is the large parcel situated between Williamsburg and Wentlings Corners near I-80 on Boyd Run. Several parcels appear at this location due to inaccuracies in the databases regarding parcel addresses. It is likely that these addresses fall outside the county lines and are based on mailing addresses rather than actual situs addresses.

Alas, the maps. Please reach out and let us know if you would like any additional views of this data. Contact Us Here

If the box below is not loading, or you want to see a full screen view of the map click the following URL: https://lookerstudio.google.com/reporting/3ea3317a-7174-4757-923d-00c8e264ac2d