Commercial Assessment Update

We wanted to provide an update on the status of our Right-to-Know (RTK) request for commercial assessment information. On January 28th, we requested the same data for commercial properties that we previously received for residential ones. This request was denied, with the county claiming they "do not possess that information." After further investigation, it became clear that they simply do not want to provide it. During the RTK process for residential properties, the county obtained the data from Vision to fulfill our request, but now it seems they are refusing to do the same for commercial properties.

The county is likely avoiding transparency regarding the reassessment process. They even requested a 30-day extension, which is typical, but in the final hours of that window, they responded in a way that left us little time to react. Ultimately, the Office of Open Records ruled that since the county doesn’t physically possess the commercial records, they weren’t obligated to request them. While the commissioner said to let them know if we needed anything, they did nothing to assist taxpayers in obtaining the information.

We filed an appeal with the Office of Open Records in Harrisburg, but the county involved their solicitor to block our access to the information. It’s unfortunate that taxpayer dollars are being used to shield commercial interests rather than promote transparency. Instead of requesting the information from Vision, the county chose to protect Vision’s interest in keeping public records private.

We encourage you to reach out to the commissioners’ office to demand transparency and access to this critical information.

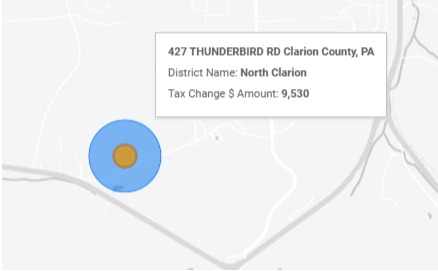

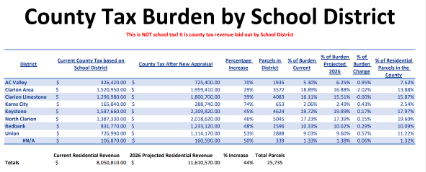

Without this data, we can only speculate. 78% of Clarion County residents are facing a tax increase amounting to $4 million. State law mandates that the revenue generated post-reassessment remains the same. Therefore, it’s reasonable to assume Vision lowered commercial property values by $4 million to offset the increase for residential properties. This is concerning, particularly because Vision is owned by *Rubicon Technology Partners, a major investment firm with **interests across the U.S., benefiting from low commercial tax rates. This lack of transparency raises serious concerns about the county commissioners' complicity in Vision’s secrecy.

Attached are the arguments from the appeal with The Office of Open Records.

*https://www.rubicontp.com/portfolio/

**https://www.rubicontp.com/news/